There is no doubt that if we talk about payments in mobile apps, China is ahead of other countries by light years. Data from 2018 shows that the total amount of transactions made with mobile payments was as much as USD 17 trillion, the number is expected to increase to USD 45 trillion by 2020. Due to the e-commerce boom and low popularity of credit cards, the Middle Kingdom is becoming a non-cash society.

Alibaba and Tencent are responsible for the digital revolution

The new trends are dominated by two strong players – Alibaba and Tencent, who are constantly fighting for a share in Chinese financial life. Each technology company processes more transactions in a month than PayPal worldwide in a year. The success of these two allows us to look to the future, where technology companies drive financial innovation, whether in retail, media or automotive. Both companies currently account for more than 93 percent of the Chinese market.

The mobile payment path was paved in 2004 by Alibaba Holding Group Ltd, to which Alipay belongs. Initially, the application was to serve only deposit functions to facilitate transactions between seller and buyer on Taobao (the world’s largest e-commerce portal, a Chinese online store owned by Alibaba). With over 900 million users worldwide (700 million in China), in 2018 Alipay already had a 54 percent share of the Chinese market and is currently one of the highest-value finite companies in the world.

When we mention the digital revolution in the area of payments, we cannot forget about Alibaba’s biggest competitor, Tencent. The company owes its leading position in the area of mobile payments in China to its own social portal and a single messenger – WeChat. The involvement of Chinese users, as well as the idea of making online purchases with the use of the application, in 2013, led Tencent to create a mobile payment system – WeChat Pay. Currently, the number of active users is over 900 million, with a market share of over 39 percent.

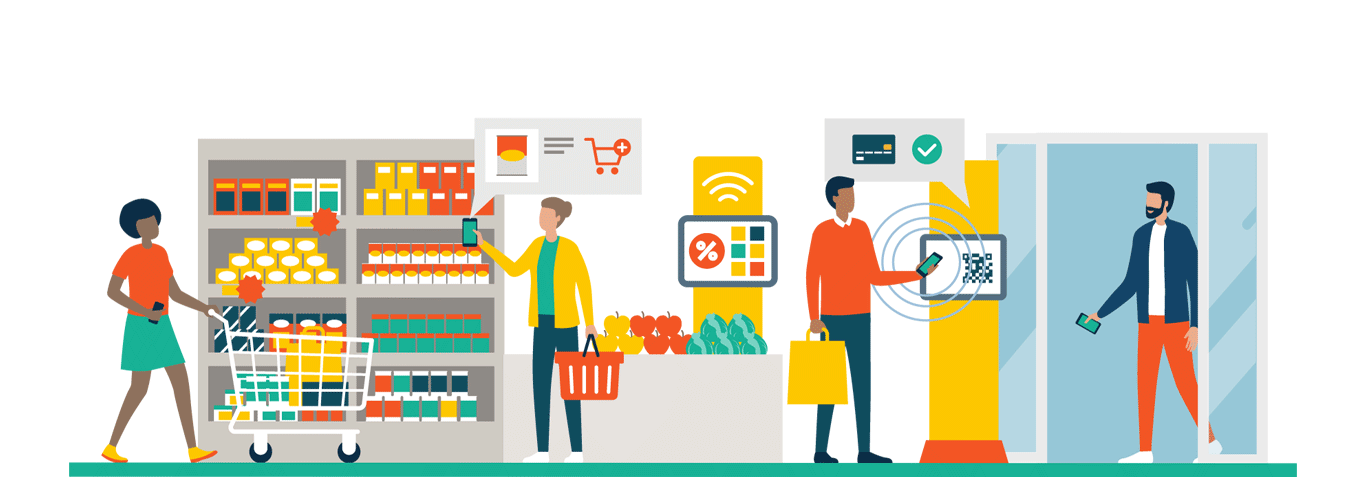

Mobile payments are not only the domain of big stores or services offering the latest technologies. Besides Taobao, Amazon, JD.com, AirAsia, 40 million stores in China use mobile applications as a payment method. Even in the street shops we find QR codes, after scanning them we are able to pay for everything (food, daily services).

Alipay and WeChat are already considered lifestyle platforms, their use has long ceased to be limited only to payments. They can be used to manage bank accounts, order meals and public transport services, purchase insurance, top up the phone, rent a bike, etc. Furthermore, an extremely large number of restaurants offer food ordering by scanning the QR code placed on the table.

What about other mobile payments?

Other global players such as Google, Amazon and Samsung are far behind, even the “veteran” of PayPal mobile payments is not able to compete with native payment systems.

Hundreds of millions of Alipay and WeChat Pay users are growing rapidly thanks to Chinese citizens, but both giants also have an appetite to conquer new markets. Companies are already expanding their operations abroad – their payment systems operate in more than 40 countries, and the Alipay application itself cooperates with more than 65 financial institutions, including MasterCard, Visa.

What can we learn from this?

On the example of Chinese payments in mobile applications, we can see how well thought-out, designed and tested application is able to become a powerful tool for contact with current and potential customers. Not to mention meeting the needs of consumers and creating their needs.

Creating a mobile application can bring the company benefits in the form of customer loyalty and commitment, standing out from the competition and increasing brand awareness.